Extreme weather events can cause significant damage to homes, and roof damage can make your home unsafe. One of the most common causes of roof damage is strong winds. After a big storm, you may be left with a lot of questions and concerns regarding your home and any damage it sustained. Is roof damage covered by my homeowners’ insurance? How long does a claim for roof damage usually take to file?

Our Bossier City roofing pros explore what to do if you experience roof damage as a result of high winds, as well as give you insight into the process for filing wind damage claims.

Understanding Wind Damage to Roofs

Severe weather events can cause a lot of problems for homeowners, especially when those weather events bring damaging winds. According to the Insurance Information Institute, the average wind and hail damage insurance claim from 2016-2020 is $11,695.

In order to understand wind damage insurance claims, we have to understand what constitutes wind damage and how you can detect it after a storm.

Types of Wind Damage to Roofs

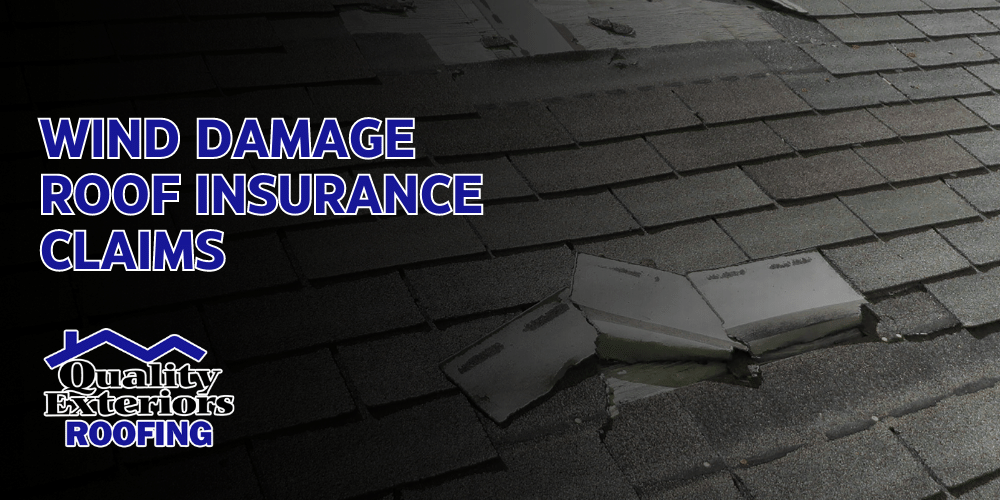

High winds can cause damage in multiple different ways. Strong winds can damage and lift off the shingles. Asphalt shingles are designed to prevent your home from sustaining water damage, so if they are cracked or blown off, you may have a leaky roof as a result. Wind damage can also cause fallen trees and other debris to be lifted into the air, which can strike your roofing structure.

Signs and Symptoms of Wind Damage

Damage caused by strong winds can be identified in a few different ways. If your home’s roof is missing shingles following a storm, you need to call a reputable roofing company to investigate the damage.

You may also be able to identify roof damage through signs of water damage, including wet spots in flooring, carpet, or insulation, as well as water spots in walls or ceilings.

Impact of Wind Speed and Intensity on Roof Damage

In Louisiana, we’re no stranger to severe weather conditions and have a long history of experiencing tornados and hurricanes, which both cause dangerously high winds.

The National Severe Storms Laboratory warns that wind that reaches over 50 mph can cause property damage. Sustained straight-line winds and strong gusts of wind both have the capacity to severely damage roofs.

Roof Insurance Coverage

Most insurance policies cover wind damage, but it’s important to understand what exactly your policy covers in the event of any roof damage insurance claims. It’s also important to understand how the average home insurance policy works and what you may have to pay after a severe weather event.

Explanation of the Standard Homeowners’ Insurance Policy

Every homeowner is required to insure their home in case of damage. Homeowner’s insurance policies include a premium and a deductible:

- A premium is the monthly or yearly amount a homeowner must pay to stay insured.

- The deductible is the amount required to repair damages before the insurance starts to cover costs.

For example, if your deductible is $1,000 and the damage costs $4,000 in repairs, you would pay the first $1,000, and your insurer would cover the remaining $3,000. While it may seem advantageous to set your deductible low, it will often cause you to pay a higher monthly or yearly premium. If you have a higher deductible, you may have lower premiums as a result.

Coverage for Wind Damage

Wind damage is typically included in most homeowners’ insurance policies and can help you recover the costs of repairing or replacing your roofing system after a severe weather event. Most policies include “dwelling coverage,” which is insurance coverage for the structure of your home and anything permanently installed in your home, like cabinets, water heaters, and your roof.

Storm deductibles are often percentage based, meaning your deductible is based on your home’s insurance rate.

Let’s look at another example: if your home is insured for $100,000 and your deductible is 5%, when you file a successful roof damage claim, you’ll have to pay up to $5,000 for repair work, and your insurer will pay the rest.

Be sure that your policy covers the natural disasters that normally occur in your area. You may not be fully covered for roof damage under your current policy, so if you are already insured, it’s important to understand what exclusions your policy includes. A public adjuster or our roofing contractors can help you understand your policy exclusions.

Key Terms and Conditions Related to Roof Insurance Claims

There are generally two ways insurance companies compensate their policyholders for damaged roofs.

The first way is when the policyholder pays the deductible and the insurance company will cover the rest of the roof replacement costs for a comparable new roof.

Insurance companies can also reimburse their policyholders with the actual cash value (ACV) of their current roof. This is essentially just the depreciated value.

Steps to Take After Discovering Wind Damage

After discovering any roof damage caused by strong winds, you’ll want to document the damages for your insurance company in order to file a claim, especially if the damage requires full roof replacement to fix.

Below are some of the steps you should take after finding roof wind damage:

Immediate Actions to Protect Your Property

Wind damage caused by extreme weather events can leave your house vulnerable to further damage like water and mold damage. While you may want to wait to schedule any permanent repair or replacement services until after your claim is approved, you may want to consider hiring a roofing company or licensed contractor to provide you with temporary repair work.

At Quality Exteriors, we provide 24/7 emergency roof repair services for Northwest Louisiana and the surrounding area. Call us today for a free estimate to understand what temporary repair services protect your home from any additional damage.

Documenting the Wind Damage

Any insurance claim is going to require proof of any storm damage, such as any wind and hail damage that your home has sustained. This can include missing shingles, water spots, wet flooring, and fallen debris.

Take extensive pictures and videos of the damages so that you can provide your insurance company with accurate documentation of all damages incurred.

Contacting Your Insurance Provider

After assessing the damage and taking any emergency measures to ensure their home is safe from further damage, homeowners should contact their insurance company to file an insurance claim for roof damages. Be sure to review your home insurance policy before filing a claim and ensure your home is covered in the event of wind damage.

Initiating the Roof Insurance Claim Process

Before you start the wind insurance claim process, it’s important to know what to expect when dealing with a home insurance adjuster. This can include setting realistic expectations of what you may be required to pay up-front, as well as how long the claims process may take.

Understanding the Claims Process and Timeline

Insurance claims require a little bit of waiting, which is why it’s so important to call your home insurance company as soon as you detect any damage to your roof. Your policy should have a required timeline you must follow to file a successful claim. The National Flood Insurance Policy, for example, requires individuals to file a claim within 60 days of a natural disaster.

Most insurance companies will send out an adjuster within 30 days of filing a claim so they can inspect the damage to your roof and home. Be sure to keep any damaged belongings that you could include in your claim. Even if your claim is approved, it may take another 30 days before you receive a check in the mail.

Gathering Necessary Documentation

After you begin the claims process, your insurance company will send out an adjuster or hire local contractors to evaluate the damage. The adjuster or contractor will inspect your roof, including the structural integrity of your roof, and any additional wind damage. They will also ask for any documentation you may have collected following the incident, such as any pictures or videos of the damage incurred.

Filing the Claim with Your Insurance Company

Once you have filed a claim within the required timeframe and an adjuster has inspected the damages, your home insurance company has the right to deny or approve your claim. If your claim is approved, you may schedule any roof repair or replacement necessary. If your claim is denied, you may be required to front any roof repair cost on your own.

Negotiating the Insurance Claim Settlement

It’s important to understand what coverage you have under your current insurance policy, including any insurance exclusions your policy may have in regard to roof damage. You’ll also want to keep a log of any correspondence regarding your claim and a list of people involved in your claim, just in case you need to dispute the claim later down the line.

Understanding the Initial Claim Offer

If your policy does cover wind damage, an insurance adjuster will evaluate your home and assess whether or not your roof has actually suffered from wind and storm damage. From there, your insurer may make an offer for any repair or replacement cost you may have you pay as a result of the damages. Their offer will depend on what kind of coverage you have under your policy.

Presenting Additional Evidence or Expert Opinions

When making an insurance claim for roof damage, if you feel as if your claim offer will not cover the cost of repair work, you may ask your insurance company to send out a second adjuster, who can give you a second opinion on your claim.

How Our Bossier City Roofers Can Help Negotiate Your Insurance Claim

At QEI, we offer assistance to any clients looking to file roof damage claims and can offer professional insight into the claims process. If you are in the process of filing a claim for roof damages, we’ll act in your best interests and provide you with the best possible assistance in filing your claim. We can even help negotiate on your behalf. Call us at (318) 747-1254 for a free evaluation.

Roof Repair or Replacement After Wind Damage

Storms involving strong winds can damage your roof and force you to schedule repair services to fix it. Quality Exteriors offers high-quality roof repair services to the Bossier City area. If you are a homeowner and have recently experienced roof damage caused by storms or even general wear and tear, our technicians can help ensure your roof is secure and your home is safe from further damage.

Evaluating the Scope of Repair or Replacement

Wind or hail damage to your roof can cause it to be susceptible to leaks, which can then cause damage to the structural integrity of your roof and damage your belongings. After filing a claim, a roofing company will evaluate the scope of the damages to your roof that was directly caused by extremely windy weather.

Obtaining Roof Repair or Replacement Estimates

After the evaluation of your roof, the company will then offer you a quote for the repair or replacement your roof needs. If the supports are unstable or the materials are old, the entire roof may need to be replaced.

At Quality Exteriors, we have homeowners in Bossier covered: we offer roof repair and replacement services, as well as 24/7 emergency repair services. Call us at (318) 747-1254 to receive a free estimate for the service you need.

Communicating with Your Insurance Company

Sometimes natural disasters happen, which is why you want your home to be insured in case of a dangerous weather event. Filing a roof damage insurance claim can help you cover the cost of repair services. If your insurance policy does cover wind damage, contact your insurer to file a claim before scheduling any repair services.

Finalizing the Insurance Claim Process

After filing an insurance claim for roof damage, a public adjuster will evaluate the damages so your insurer can decide whether or not to approve your claim. Here’s what you should do after you have filed a claim for damage caused by strong winds.

Reviewing the Settlement Agreement and Documentation

Approved homeowners’ insurance claims involve a settlement agreement, which is the amount your insurance company is willing to reimburse you for your damages. This amount depends on the policy you pay for and the estimated cost of repair. If you believe this settlement won’t cover the cost of repairs, you may be able to request a second opinion, but be careful when receiving multiple estimates. Your insurer may just choose the cheapest estimate amount and only agree to settle for that amount.

Disbursement of Insurance Funds

If your insurance company decides that your repairs are covered by your policy, they will then send you a check for the agreed amount. If the repair cost exceeds the initial estimated cost, you may be able to file a supplemental claim and request that they cover any additional repair cost.

Retaining Copies of Relevant Documents

Be sure you make copies of all correspondence between you and your insurer, as well as copies of documents relating to your claim, including settlement offers for the wind damage.

Tips for Preventing Future Wind Damage

If your roof suffers damage from a severe storm or natural disaster, you’ll need to schedule repairs and may even need to replace your entire roof. It’s important to be proactive and repair any roof issues you encounter as soon as you can so that you can prevent additional damage to your home and roof.

Implementing Preventive Measures

Your homeowners’ insurance policy may only cover any wind-related roof repair if your roof was well maintained before the damage was caused. It’s important to regularly maintain your roof and check for damages after a weather event. QEI’s preventative roof maintenance services can help you save money on repairs and protect your home from damage.

Reinforcing Roof Structures

The lifespan of the average roof is about 15-20 years, so if your roof is over 15 years old, consider having it inspected and installing or reinforcing roof supports.

Reviewing and Updating Insurance Coverage

Even if your roof hasn’t recently experienced damage, you should review your current policy to ensure you can file an insurance claim for wind damage. If you aren’t covered in the event of wind damage, you can update your policy to include wind and hail damage.

Work With Bossier’s Most Trusted Roofing Contractors

If your roof has been damaged by winds, QEI can evaluate and repair the damage and even communicate with your insurance company on your behalf. With over 35 years of serving Northwest Louisiana and the surrounding area, you and your family can rest assured that your home is in the best care possible. Call us at (318) 747-1254 to schedule a free estimate for our roof repair and replacement services.